Banks Fight For Your Business

As brokers, we shop your scenario with 30+ lenders to get you the best rate.

No Lender Fees

We don't charge any lender fees, saving you on average $1,600 over retail banks.

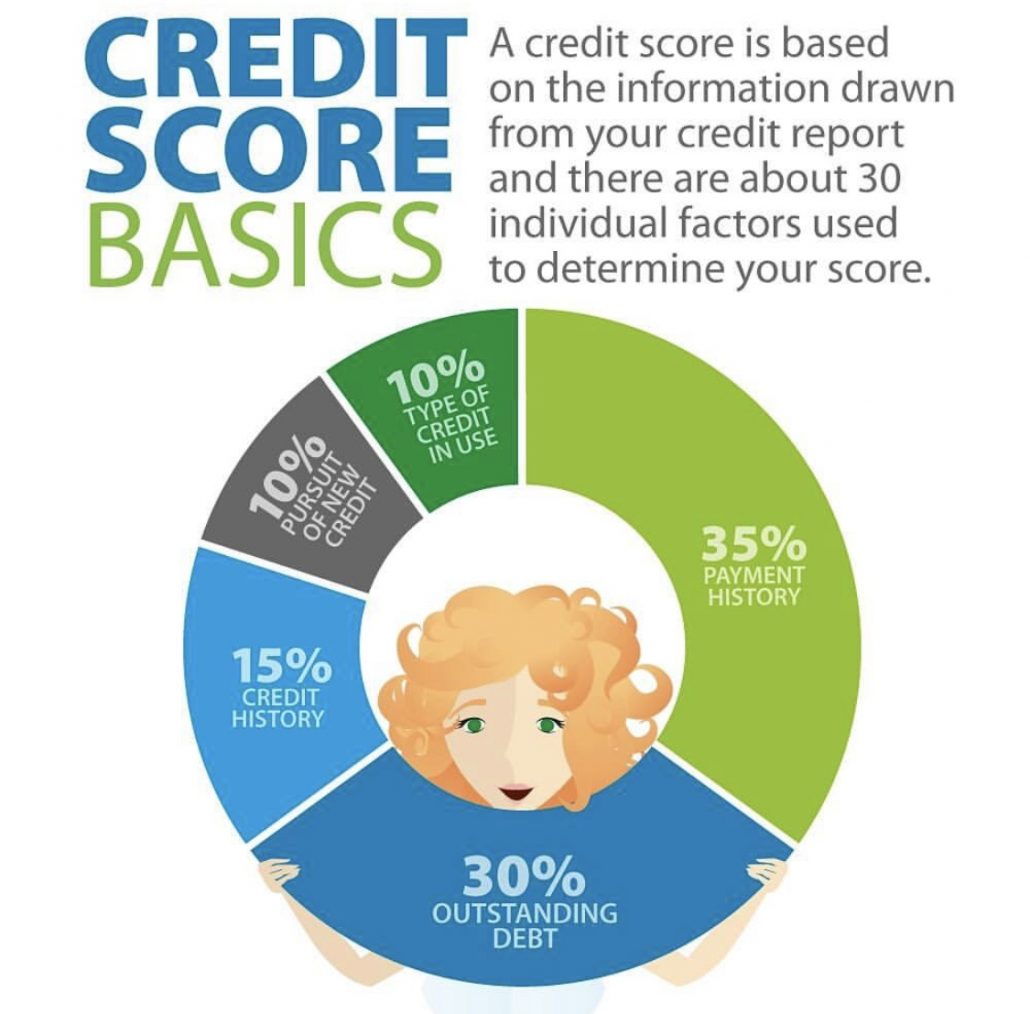

Won't Impact Credit Score

We make sure the numbers work before running your credit.

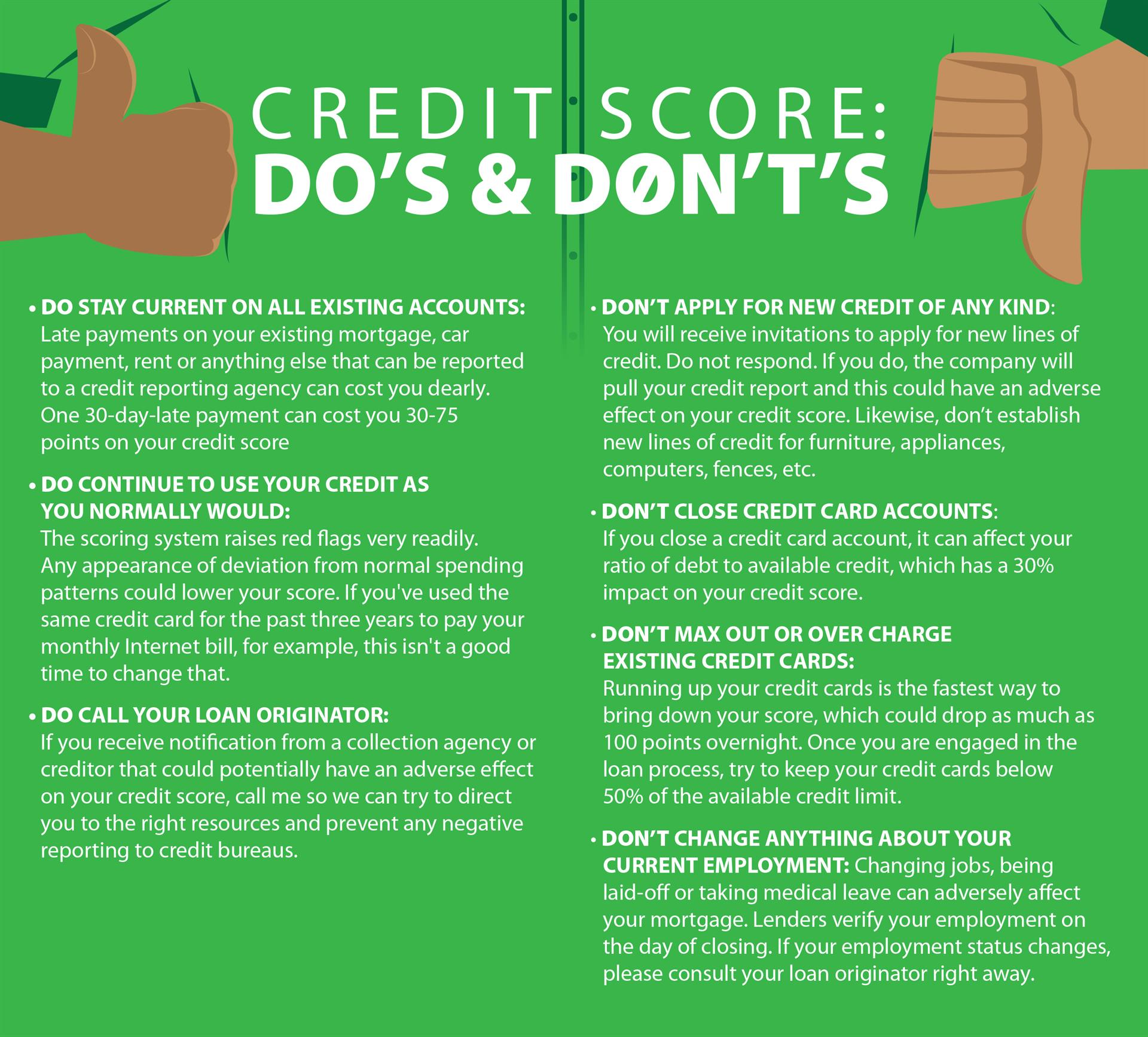

✅ Think twice before jumping on that latest 0% credit card offer or opening a new card just to get a 10% discount at a department store.